Domestic airfares generally fell last year after reaching record highs in late-2022, but cancellations and delays remain higher than long-term industry averages, the ACCC’s latest Domestic Airline Competition in Australia report reveals.

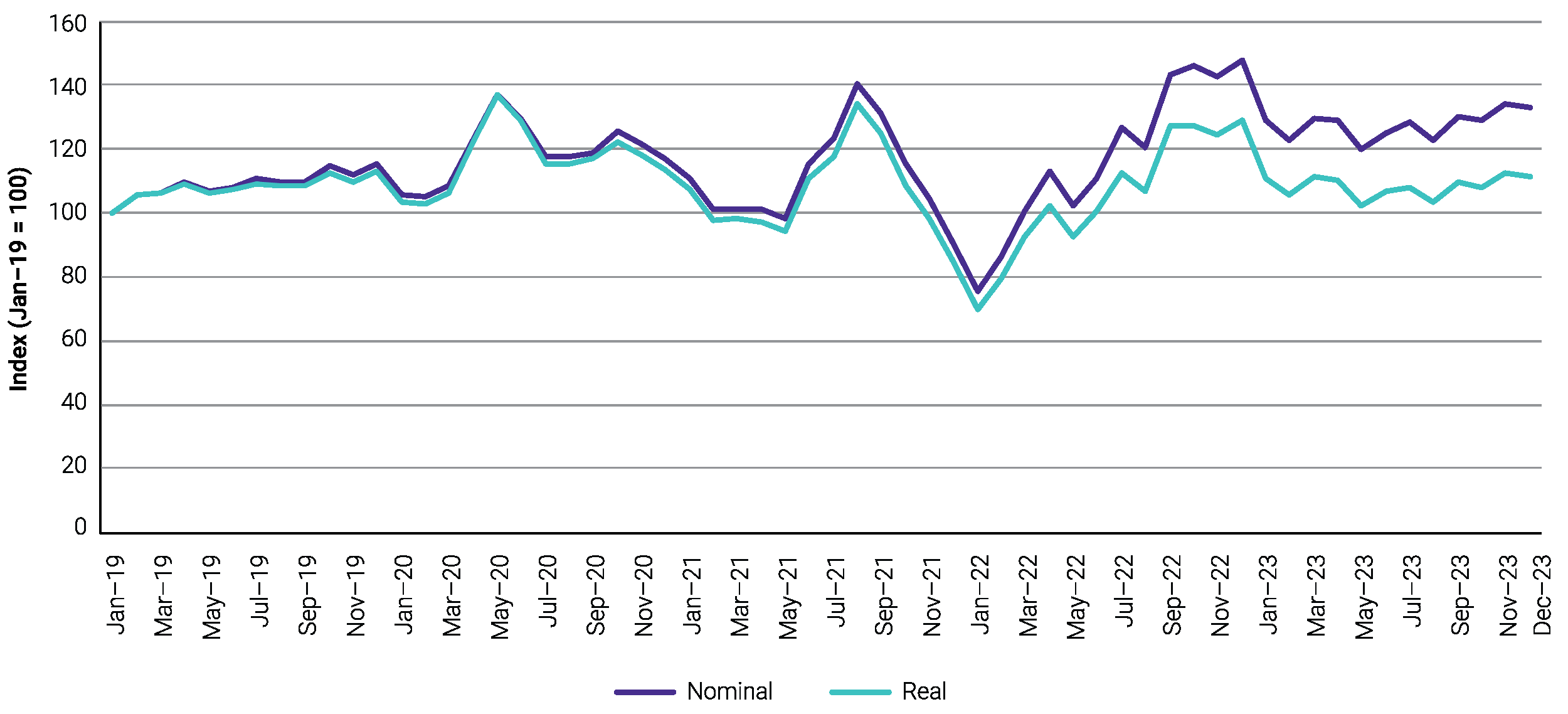

The report shows that average revenue per passenger, which represents average prices across all fare types, was 13.4 per cent lower in December 2023 than in December 2022, in real (inflation-adjusted) terms.

“Travellers finally saw some relief from high airfares last year, which was consistent with cheaper jet fuel prices and slightly lower demand for domestic air travel,” ACCC Chair Gina Cass-Gottlieb said.

Average revenue per passenger in December 2023 was also below pre-pandemic levels (December 2019), in real terms; however, ‘best discount’ economy airfares remain higher than they were in December 2019.

While domestic airfares have improved to some degree for consumers, service reliability remains a significant concern.

In December 2023, five per cent of flights were cancelled, which is more than double the long-term average. Only 63.6 per cent of flights arrived on-time in December 2023, compared to the long-term average of 81.1 per cent.

“The persistently high rates of cancellations and delays compared to long term averages in the second half of last year were clearly disappointing for consumers,” Ms Cass-Gottlieb said.

Airservices Australia has acknowledged that a shortage of air traffic controllers has in part contributed to this poor performance.

Passenger levels and capacity stabilise

After several years of fluctuations associated with the pandemic, passenger levels and capacity in the domestic airline industry appear to be stabilising.

In December 2023, about 4.8 million people flew domestically, which is about 94 per cent of pre-pandemic (December 2019) levels. The passenger rate has generally stayed between 90 and 95 per cent since December 2022.

In December 2023, the airlines’ combined seat capacity was six million, which is about 95 per cent of the capacity in December 2019.

“The last four years have been a particularly unstable period for the domestic airline industry,” Ms Cass-Gottlieb said.

“Although passenger levels and capacity have not quite returned to pre-pandemic levels, the industry appears to have largely moved on from its recovery phase and is now exhibiting more typical seasonal trends.”

Four airline groups now competing on Gold Coast-Melbourne route

When new low-cost carrier, Bonza, began offering services between the Gold Coast and Melbourne in November 2023, Australia had four different airline groups competing on a domestic route for the first time. Bonza joined the Qantas Group (including Jetstar), Rex and Virgin Australia on the Gold Coast-Melbourne route.

Across Australia, about half of all domestic passengers in December 2023 flew on routes with either three or four competing airline groups. However, Rex and Bonza typically offer far fewer services on those routes than Qantas Group and Virgin Australia.

“When more airline groups compete on a particular route, consumers benefit from lower fares,” Ms Cass-Gottlieb said.

“Qantas and Jetstar, however, continue to fly over 60 per cent of domestic passengers, representing a very high market concentration.”

ACCC’s monitoring and reporting role recommences

This report is the first under the ACCC’s reinstated domestic airline monitoring direction. It follows three years of monitoring from 2020-23 under a previous Government direction.

The ACCC’s scrutiny of this market will help ensure airlines compete on their merits and will seek to bring to light any inappropriate market conduct, should it occur. In particular, the continued transparency will assist new and expanding airlines that are still trying to establish themselves.

Index of average fare revenue per passenger across all routes – January 2019 to December 2023

Source: ACCC calculations using data from the ABS and data collected by the ACCC from Bonza, Jetstar, Qantas, Rex and Virgin Australia.

Note: The average revenue per passenger includes both economy and business fare revenue. It excludes data associated with ancillaries, such as baggage fees, and food and drink sold on board. Data has been adjusted for inflation using ABS CPI quarterly data up to December 2023.

Airline cancellation rates – January 2022 to December 2023

Source: BITRE, On-time performance time series – December 2023; data collected by the ACCC from Bonza. Qantas figures include QantasLink and Virgin Australia figures include VARA.

Note: A flight is regarded as a cancellation if it is cancelled or rescheduled less than 7 days prior to its scheduled departure time.

Airline passenger market shares across all domestic routes – January 2021 to December 2023

Source: Data collected by the ACCC from Bonza, Jetstar, Qantas, Rex and Virgin Australia.

Background

On 6 November 2023, the Treasurer directed the ACCC to recommence domestic air passenger transport monitoring. Under this direction, the ACCC is to monitor and report on the domestic airline industry for a period of three years. This is the first report under the new direction, which expires in December 2026.