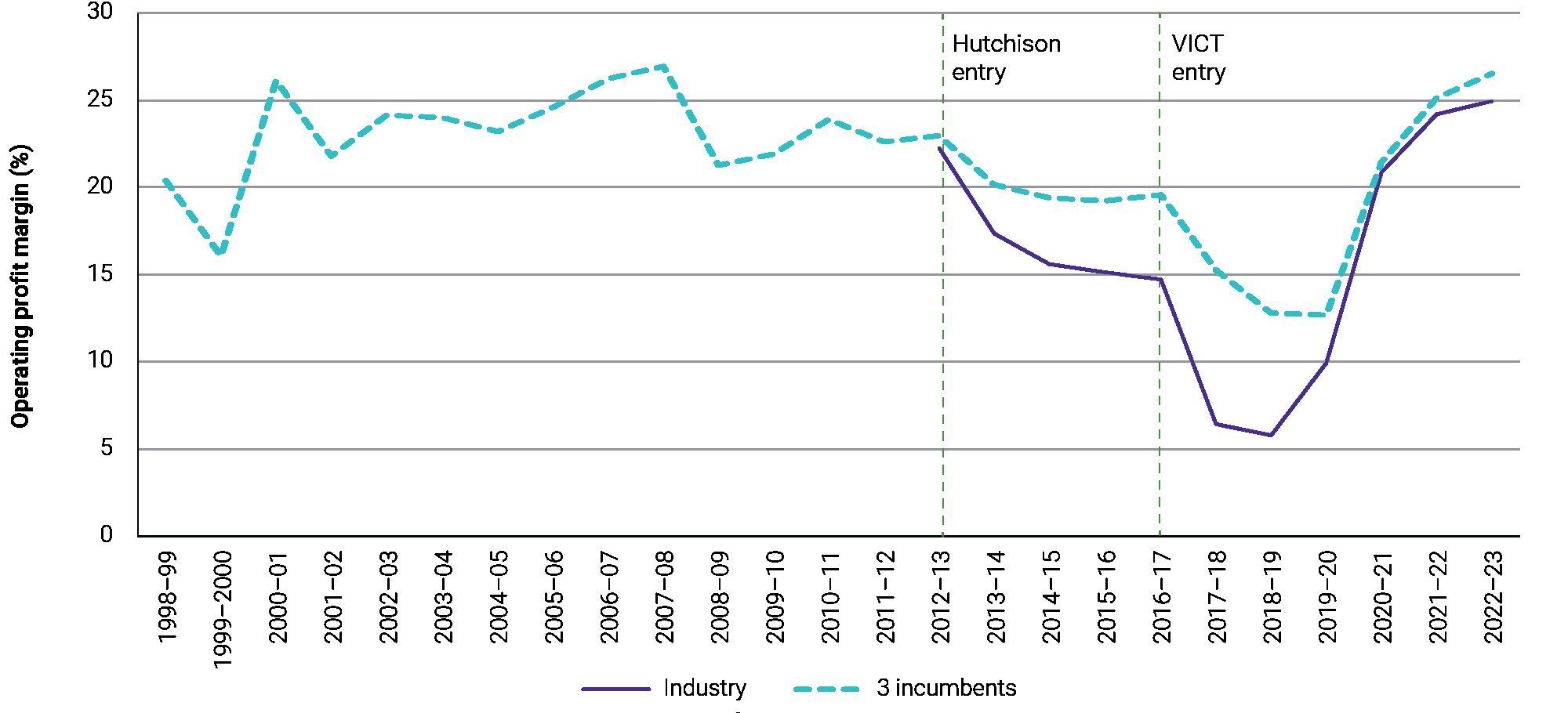

The operating profit margin of Australia’s container stevedoring industry increased to 24.9 per cent in 2022-23, continuing a trend of rising profit margins since a low of 5.8 per cent in 2018-19, the ACCC’s Container Stevedoring Monitoring Report 2022-23 shows.

While the industry profits have rapidly increased in the past few years, the ACCC believes it is too soon to know whether the current profit margins are likely to be sustained.

The ACCC is currently considering what further analysis it could undertake of the stevedores’ high profit margins of recent years.

Stevedoring is a capital-intensive business and the large investments they make are not steady or uniform, so the industry’s financial performance does need to be considered over a longer timeframe.

The stevedores recorded historically low profit margins before the COVID-19 pandemic, and the industry’s average operating profit margin between 2012-13 and 2022-23 is 16 per cent.

“While we have not formed a conclusive view on the stevedores’ profit margins, we are concerned by emerging evidence that the two new entrants of the last decade, Hutchison and VICT, are not constraining the incumbent multi-port stevedores as effectively as we had hoped,” ACCC Commissioner Anna Brakey said.

“Due to their focus on efficiency and cost minimisation, at least some shipping lines appear to be preferencing the same stevedore across multiple ports, which advantages Patrick and DP World.”

Patrick and DP World operate at Melbourne, Sydney, Brisbane and Fremantle ports. Hutchison (Sydney and Brisbane) and Victoria International Container Terminal (Melbourne) may be less attractive to shipping lines as they do not have a national presence, the report explains.

“Australia is a trade-exposed country and many of the goods that we rely on in our everyday lives come through our container ports,” Ms Brakey said.

Figure 1: Stevedores’ total operating profit margins, industry & 3 incumbents: 1998–99 to 2022-23

Source: ACCC analysis of information received from stevedores as part of the monitoring regime.

Supply chain recovery

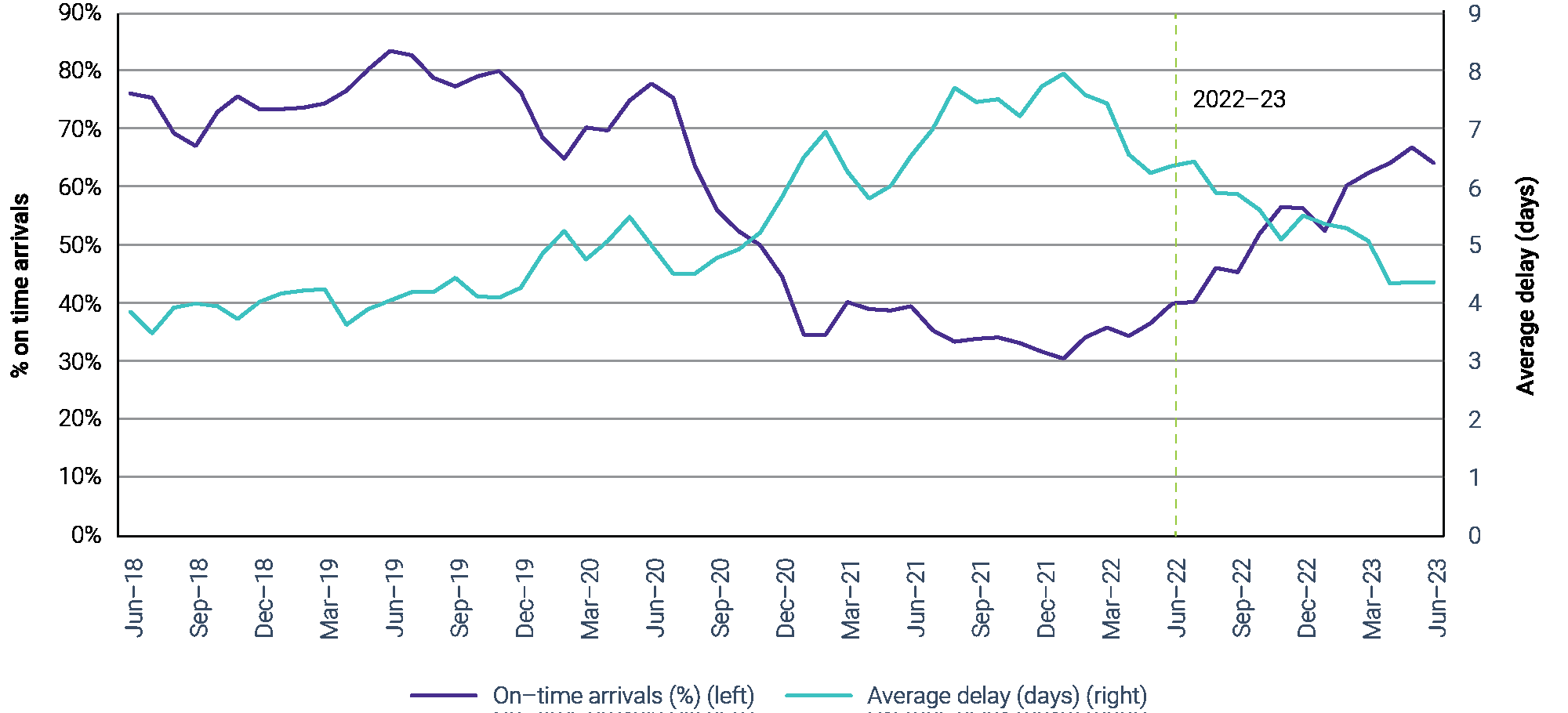

The report explains that the container freight supply chain operated more predictably in 2022-23, after two years of major pandemic-induced disruption.

Global vessel schedule reliability increased from 39.9 per cent in June 2022 to 64.2 per cent in June 2023. However, vessel schedule reliability is still worse than it was before the pandemic, and the ACCC understands that Australia may lag the global average.

Industry participants have told the ACCC that some shipping lines have restructured their Australian services to visit fewer ports and minimise the impact of potential delays.

“We think it’s likely that delays, lower container volumes, higher shipping costs and lower freight rates have all contributed to the decision by some shipping lines to streamline their Australian services,” Ms Brakey said.

While Australian freight rates have largely returned to their pre-pandemic levels by June 2023, the ACCC understands that at least some exporters have been paying higher rates due to the shortage of food-grade refrigerated containers.

Figure 2: Global vessel schedule reliability and average vessel delays, major global routes, June 2018 to June 2023

Source: Sea-Intelligence, ‘Global Liner Performance Report’, Issue 144, Sea-Intelligence, 2023. The data covers 34 trade lanes, including Asia-Oceania.

Recommendations

The ACCC believes several key reforms are needed to improve the efficiency of the container freight supply chain, despite the considerable improvements over the last two years.

Importers and exporters cannot currently access some of the key information they need to make business decisions, including how stevedore and empty container park fees will change over time. As such, the ACCC supports making it easier for cargo owners to determine all costs related to shipping lines’ services, including those charged by stevedores and empty container park operators.

The report also reiterates the ACCC’s view that importers and exporters need more protection against unreasonable detention fees. Shipping lines charge detention fees for continuing to use containers beyond an agreed period. These fees become unreasonable in circumstances where importers and exporters cannot return containers on time due to factors outside their control.

The ACCC also supports the Productivity Commission’s recommendation that Part X of the Competition and Consumer Act be repealed and replaced with a more targeted exemption for shipping lines.

Background

The ACCC has monitored the container stevedoring industry since 1998-99, under a direction from the Australian Government.

Container stevedoring involves lifting containers on and off ships. The ACCC currently monitors the prices, costs and profits of container stevedores at five Australian container ports: Adelaide, Brisbane, Fremantle, Melbourne and Sydney.

Given the interconnected nature of the container freight supply chain and the strong interest in pandemic-era trade disruptions, the last three reports have included broader analysis of supply chains.