Residential electricity bills were higher across most National Electricity Market states in the September quarter last year compared to the equivalent quarter in 2021, the ACCC’s latest Electricity Market Inquiry Report reveals.

The report presents analysis of 13 million residential and small business electricity bills in New South Wales, Victoria, South-East Queensland, and South Australia, between July and September 2022.

It explains that electricity bills will increase further this year as the record high wholesale prices from mid-2022 continue to flow through to customers; however, government rebates from 1 July this year will provide some relief to eligible households (up to $500) and small businesses (up to $650).

“Wholesale electricity prices have eased since their peak in the middle of 2022, but we expect electricity bills to increase further this year due to the lag in wholesale costs flowing through to customers,” ACCC Commissioner Anna Brakey said.

“Energy retailers enter into supply contracts with generators years in advance to manage volatility, so households haven’t yet seen the full impact of last year’s wholesale price spikes.”

ACCC is monitoring retailer communications

A number of energy retailers recently announced increases to their market offer prices from 1 July, and some customers have already received price change notifications indicating significant increases. The ACCC is closely monitoring retailers’ price changes, as part of both its ongoing electricity market inquiry and enforcement of the Electricity Retail Code.

“Retailers have certain legal obligations under the Electricity Retail Code to communicate price changes in a way that allows people to compare different plans,” Ms Brakey said.

“Any retailer that breaches the electricity code or seeks to mislead consumers about the reasons for electricity prices increasing can expect our attention."

Retailers CovaU and ReAmped Energy this week each paid $33,300 in penalties for allegedly sending communications to customers without certain information required under the code. CovaU also provided the ACCC with a court-enforceable undertaking, committing to inform impacted consumers and improve compliance in future.

Retailer Blue NRG also this week agreed to compensate several business clients and provided a court-enforceable undertaking to the ACCC after it admitted it made false or misleading representations when telling some customers on fixed-rate contracts that it had a legal right to raise electricity prices, when it did not.

“The ACCC will continue to monitor retailer communications to ensure retailers are meeting their obligations. But more than ever, in the current environment of rising energy prices and cost of living pressures, it’s important for people to see if they can reduce their electricity bills by switching to a better plan,” Ms Brakey said.

“We encourage all households and small businesses to use the government-run websites Energy Made Easy and Victorian Energy Compare to see if there is a cheaper offer available.”

“We advise waiting until after 1 July, when many retailers will have updated their energy plans. Customers can then have greater certainty about the prices they will be paying and compare the largest range of available offers in the market,” Ms Brakey said.

Key findings of the latest report

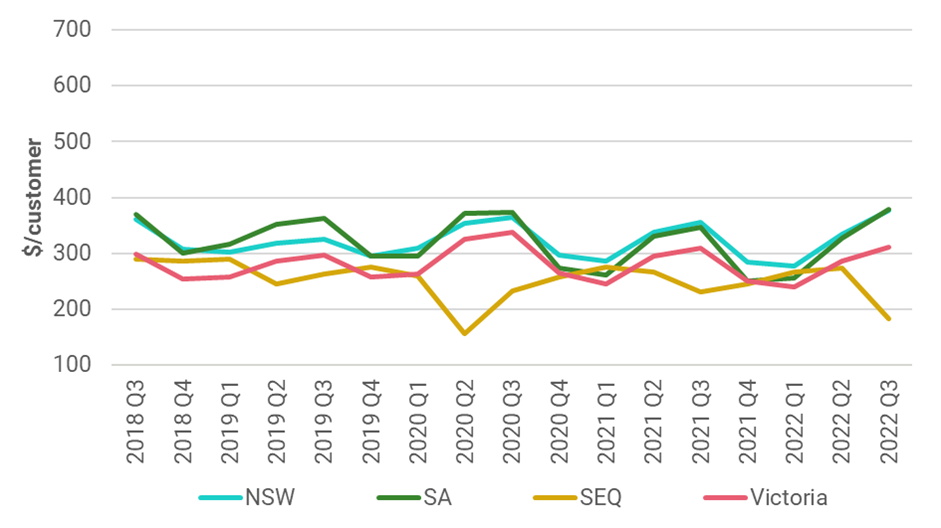

South Australian households experienced a 9.1 per cent increase in their quarterly median electricity bills between the September quarters 2021 and 2022, which was the highest of all National Electricity Market regions. In comparison, New South Wales residents saw a 6.4 per cent rise in their bills, and Victorians 0.6 per cent.

In South-East Queensland, there was a 20.4 per cent decrease in median residential bills in the September quarter 2022 due to the Queensland Government’s $175 Cost of Living Rebate for Households being applied to bills in that quarter.

The image shows the median bills paid by residential customers by region, all quarters, from 3rd quarter 2018 to 3rd quarter 2022.

Source: ACCC analysis of retailer billing data. Nominal dollars, excluding GST.

Notes: The Queensland Government provided a $50 ‘dividend’ in 2018, 2019, 2020 (twice) and 2021, plus a $175 rebate in 2022. The Queensland Government also gave a $200 rebate to more than 2 million households in 2020 as part of its COVID-19 economic relief package. The $200 rebate allocated $100 for electricity bill relief (compromising of the 2 $50 ‘dividend’ payments mentioned above) and $100 towards water bill relief. However, the entire $200 rebate was applied as an automatic credit on electricity bills.

For small businesses across all regions, the quarterly median electricity bill increased by 13.1 per cent between the September quarters 2021 and 2022.

Offers for new customers increase

As well as showing the prices customers pay in arrears through their quarterly bills, the report presents data on new offers available in the retail market. It estimates that the median annual bill for residential customers who took up a new market offer in March 2023, and maintained their consumption, would be 17 per cent higher than it was in April 2022.

Market offers are generally more competitive, tailored plans that retailers make available to customers who shop around, as opposed to the regulated standing offers that act as an electricity price safety net.

Market offers have traditionally been cheaper than standing offers but more recently the average price of the two types of offers have moved closer together. In some cases, market offers are now more expensive than standing, underscoring the need for customers to shop around.

The report shows that the percentage of customers on standing offers increased last year. This was driven by greater uptake in Victoria, where the proportion of residential customers on standing offers increased from 7.7 per cent in 2021 to 12.0 per cent in 2022.

The ACCC’s analysis shows that households were able to save money by choosing a plan that includes demand or time-of-use tariffs. However, it warns that customers on plans with demand tariffs who are not able to manage the time and intensity of their electricity usage are at risk of higher bills.

For time-of-use tariffs, savings are contingent on people being able to move their electricity consumption to cheaper times, such as the middle of the day or late at night.

Hardship and payment plan customers

Residential customers on a payment plan or hardship program who received no other form of bill support had the highest median electricity bills of all customer groups in the September quarter 2022. Their bills were about $160 more than the median bills of residential customers who received no support.

Higher bills for these customers reflect higher electricity usage, particularly hardship customers who have the highest median electricity usage of all groups.

“There is an important equity component to the higher electricity usage and bills of hardship and payment plan customers as many people either cannot afford or aren’t able to access rooftop solar or more energy efficient homes and appliances,” Ms Brakey said.

The report shows the number of hardship customers on a payment plan increased by 17 per cent between the third quarters of 2021 and 2022; however, the number of customers on a payment plan who receive no further support fell by 8 per cent over the same period.

“Electricity retailers have important obligations to identify and assist customers who are having trouble paying their bills. Acting early gives retailers the best opportunity to support households in stress and keep people connected, particularly as prices are rising,” Ms Brakey said.

Background

This report examines the early impacts of the electricity wholesale market conditions experienced in mid-2022 and captures billing outcomes and effective prices faced by residential and small business electricity consumers across New South Wales, South Australia, South East Queensland, and Victoria.

Western Australian and the Northern Territory are not connected to the National Electricity Market, and retail electricity prices for many customers are still regulated in the Australian Capital Territory, regional Queensland, and Tasmania.

To inform this report, the ACCC has collected 13 million electricity bills. This data set contains information on charges, tariff types, usage, discounts and solar.

Not all rebates and concessions are paid via electricity retailers and, depending on the jurisdiction and the type of rebate, are sometimes paid directly to consumers. As a result, if applied directly to electricity bills, rebates and concessions from governments reduce median bills and median effective prices in our analysis.

In August 2018, the then Treasurer, the Hon Scott Morrison MP, directed the ACCC to hold an inquiry into the prices, profits and margins in relation to the supply of electricity in the National Electricity Market. This is the ninth time the ACCC has reported as part of this inquiry.

The report is available on the ACCC’s website at Electricity market monitoring 2018-25.

The next report is scheduled for December 2023.