Australia’s east coast gas market is expected to have enough supply to meet overall demand in 2024, the ACCC’s June 2023 interim gas inquiry report reveals. But the outlook for winter this year and next is finely balanced, and the southern states will be reliant on Queensland’s surplus gas.

The report looks at gas supply and demand into next year, and shows the contract prices negotiated by gas producers and commercial and industrial users between September 2022 and February 2023.

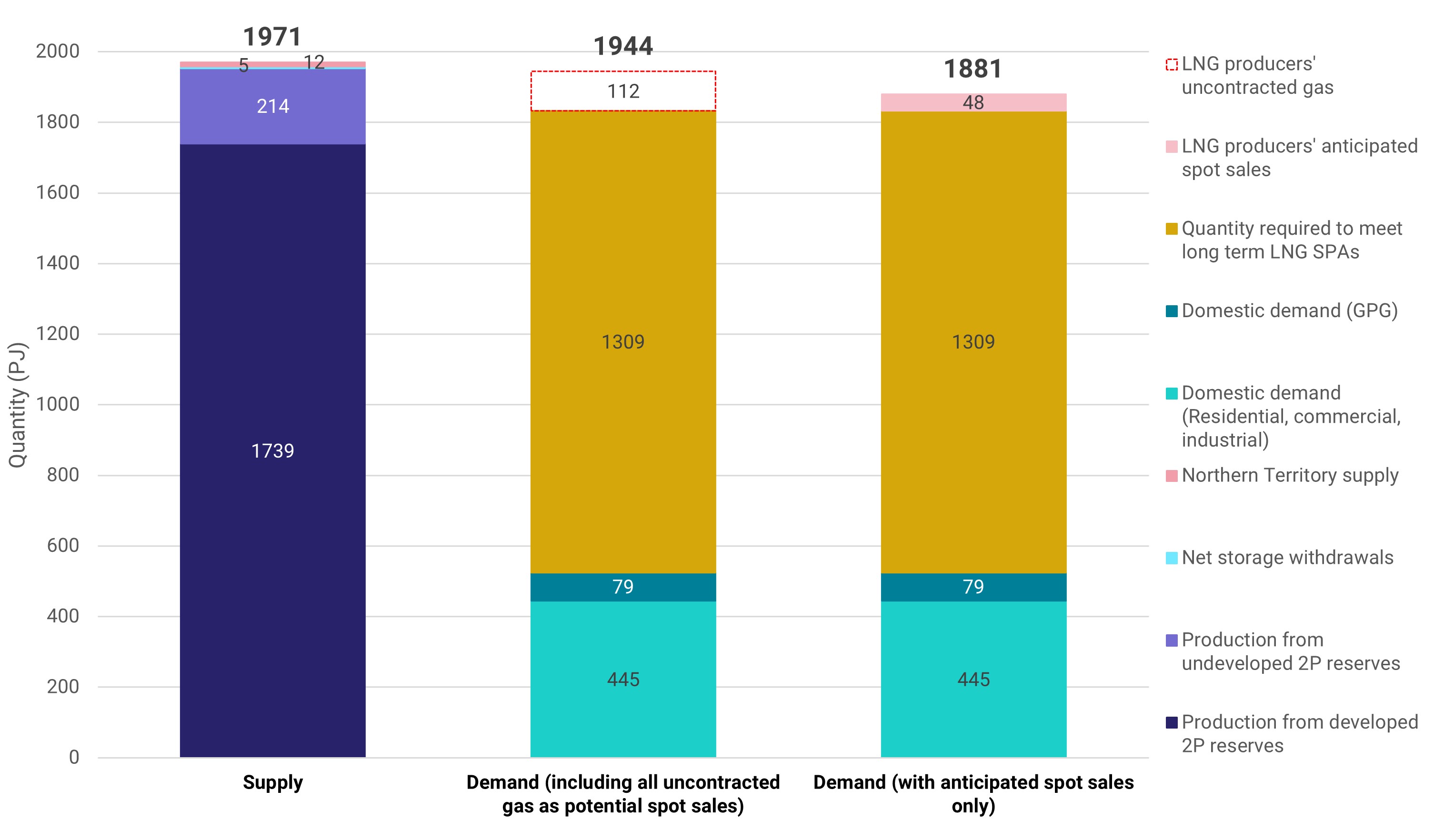

The report forecasts a 27 petajoule (PJ) east coast gas surplus for next year if the LNG producers export all their currently uncontracted gas. It predicts a 90 PJ surplus if the LNG producers export only their currently anticipated spot sales.

However, while there should be sufficient gas to meet forecast demand across the east coast in 2024, the southern states are expected to experience a shortfall. Considerable transport and storage capacity will be required to deliver Queensland’s surplus gas to those states.

“The significant improvement in the supply and demand outlook for next year is largely due to a drop in the forecast demand for gas-fired electricity generation,” ACCC Commissioner Anna Brakey said.

“Weather and electricity market conditions have a strong influence on the amount of gas-fired generation we need in the energy mix, so the demand outlook remains somewhat uncertain.”

“While the overall east coast is projected to have surplus gas next year, it is imperative that gas flows from Queensland to the southern states, and that there is enough storage for it,” Ms Brakey said.

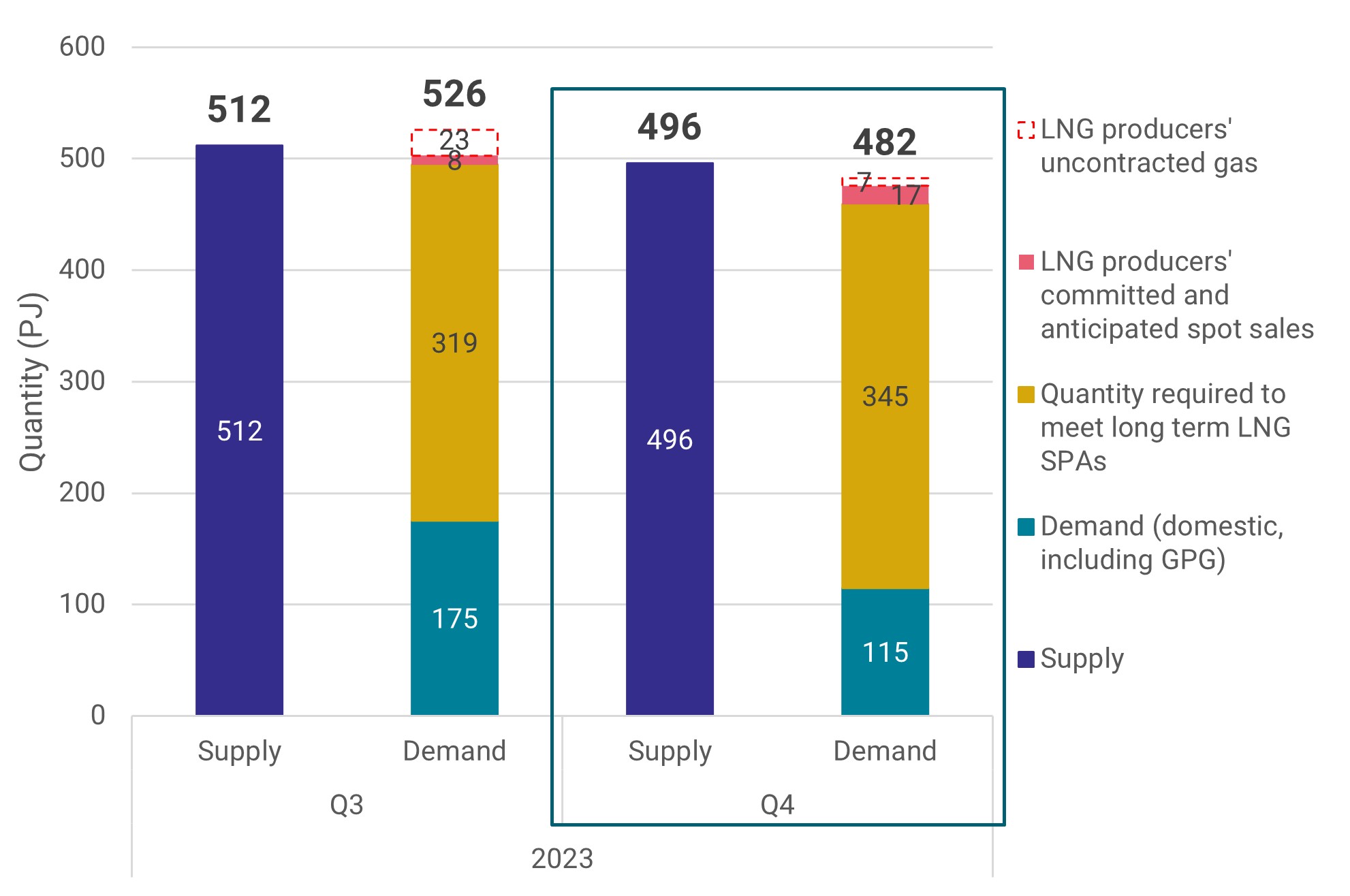

The report also emphasizes that the winter months will be challenging for gas markets as the supply-demand outlook in the third quarters of 2023 and 2024 is tight.

Availability of gas over the winter months will depend on whether LNG producers commit additional gas to the domestic market via contracts or time swaps. However, the quarterly outlook could deteriorate further if there are unexpected events such as last year’s floods, which disrupted energy supply.

Government intervention

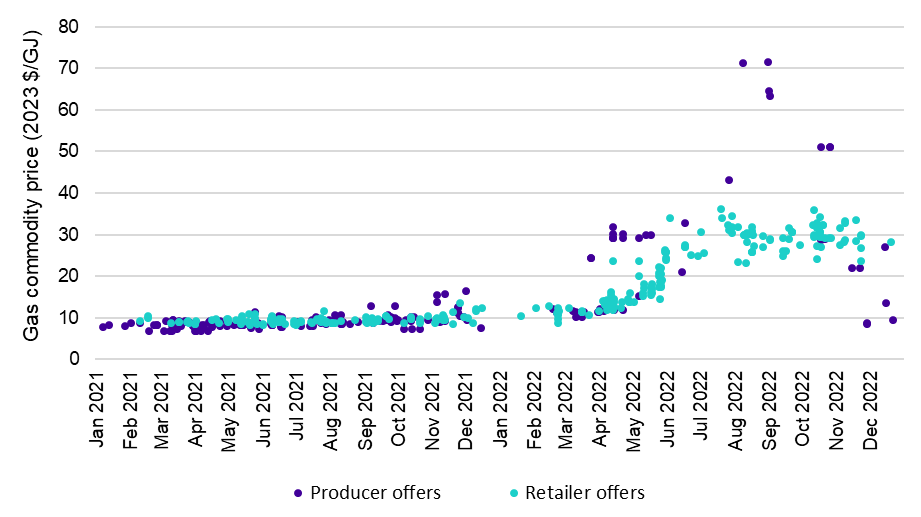

Prices offered for 2023 supply on the east coast remained high last year until shortly before the Government introduced an emergency gas price cap on 23 December 2022.

Since the price cap came into force, the ACCC has observed an increase in the volume of gas sold under short term contracts for 2023 supply. Most of this gas has been sold below $12 per GJ, but the ACCC is continuing to carefully review the details and circumstances of any contracts that could be in excess of the $12 per GJ price cap.

There may be valid reasons for gas to be sold above $12 per GJ for supply in 2023. For example, where a gas company has been exempted from the price cap, or where the price was determined by a contract entered into before the price cap came into force on 23 December 2022.

“Based on our monitoring to date, we have seen a high level of compliance with the gas price cap. But we are ready to use our full enforcement powers in response to any possible contraventions,” Ms Brakey said.

Fewer offers for supply in 2024 and higher prices

The ACCC has observed fewer offers for supply in 2024 compared to previous years, despite contracts for next year not being subject to the price cap. This may be due to a combination of factors, including seasonal slowdown and the industry’s response to regulatory uncertainty.

“Contracting activity for 2024 supply has slowed down considerably compared to previous years. However, the imminent commencement of the new mandatory Code of Conduct is expected to provide industry with the certainty they have been seeking to enter into supply contracts into the future,” Ms Brakey said.

Prices offered by producers for 2024 supply peaked at just under $50 per GJ in August last year, before falling to just over $12 per GJ at the end of last year.

Despite not being subject to the cap, most recent producer offers for 2024 supply have settled at slightly over $12 per GJ, while retail offers have averaged about $20 per GJ.

C&I users report unsatisfactory market practices

Australia’s commercial and industrial gas users reported in April 2023 that the prices they were quoted for supply in 2023-24 by retailers, who are not subject to the price cap, fell to about $19 per GJ.

Despite prices easing, users have reported receiving fewer offers for supply, and a deterioration in contract flexibility and selling practices since the ACCC’s January 2023 report.

“The difficulties that users have reported to us about their contract negotiations with gas producers underscore the importance of the mandatory Gas Code of Conduct that the Government is finalising,” Ms Brakey said.

“We expect the code will improve selling practices and level the negotiating playing field through various conduct provisions, including a requirement for producers and buyers to negotiate in good faith.”

Chart 1: Quarterly supply-demand outlooks for Q3 and Q4 2023 (PJ)

Source: ACCC analysis of data obtained from gas producers in April 2023 and of the domestic demand forecast (Orchestrated Step Change scenario) from AEMO's 2023 GSOO. As the upcoming ADGSM assessment quarter Q4 has been highlighted. Note: Totals have been rounded.

Chart 2: Forecast east coast supply-demand balance in 2024 (PJ)

Source: ACCC analysis of data obtained from gas producers in February 2023 and the domestic demand forecast (Orchestrated Step Change scenario) from AEMO's 2023 GSOO. Note: Totals have been rounded.

Chart 3: Gas commodity prices (2023$/GJ) offered in the east coast gas market for 2023 supply

Source: ACCC analysis of bid and offer information provided by suppliers.

Note: Prices are for gas commodity only. Actual prices paid by users may also include transport and retail cost components. All offers are for quantities of at least 0.5PJ per annum and a contract term of at least 12 months. Some offers in the chart may be between the same supplier and buyer and/or represent further offers between parties if a previous offer did not result in the execution of a GSA.

Background

The ACCC’s next report on the supply-demand outlook will be published in September 2023, and the next full interim report will be in December 2023.

The ACCC has also commenced a review into retailer pricing. The review will consider, among other things, the impact of the Gas Code of Conduct on the prices that gas users pay. The ACCC will report these findings in its December 2023 report and will provide advice in relation to retail gas supply to the Australian Government if necessary.

In 2017, the Australian Government directed the ACCC to conduct a wide-ranging inquiry into the supply of and demand for natural gas in Australia, and to publish regular information on the supply and pricing of gas. The ACCC will conduct the inquiry until 2030 after the Government extended it 2019 and again in 2022.

On 6 June 2022, the Treasurer wrote to the ACCC conveying his concern about the significant increases in wholesale electricity and gas prices and setting out his expectation that the ACCC will ensure the factors influencing prices in the market are made transparent, making any appropriate policy recommendations and investigate concerns about anti‑competitive and false and misleading conduct in electricity and gas markets.

On 29 September 2022, east coast LNG exporters and the Australian Government renewed and updated the Heads of Agreement. Under the terms of the new Heads of Agreement, excess gas produced by the LNG exporters must be offered to the domestic market for reasonable supply periods, with reasonable notice, on competitive market terms and at internationally competitive prices, before being offered to the international market.

On 22 October 2022, the Treasurer requested the ACCC work with his department to review the voluntary gas code of conduct and provide advice to improve its operation with the intention of making it mandatory.

On 23 December 2022, an emergency order came into effect which applies a temporary price cap on the supply of regulated gas.

On 14 June 2023, the Government announced that it had completed the design of the Mandatory Gas Code of Conduct.