Retail diesel prices dropped significantly in the March quarter 2023 while petrol prices remained broadly stable, which resulted in the gap between diesel and petrol prices narrowing, the ACCC’s latest petrol monitoring report has found.

Quarterly average retail diesel prices in Australia’s five largest cities fell by 10 per cent between the March quarter 2023 and the previous quarter (down by 23.2 cents per litre (cpl) to 199.7 cpl). In contrast, quarterly average retail petrol prices fell marginally by 0.5 cpl to 182.2 cpl.

As a result, the difference between diesel and petrol prices was significantly lower in the March quarter 2023 (17.5 cpl) than it had been in the previous quarter (40.2 cpl) and has since narrowed further.

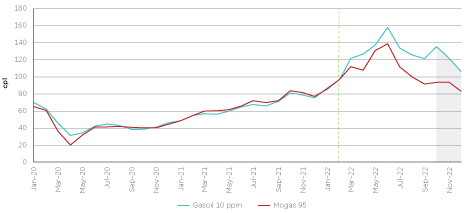

After the Russian invasion of Ukraine in February 2022, the international benchmark price for refined diesel (Singapore Gasoil 10 ppm), rose significantly above the benchmark for refined petrol (Mogas 95) as global supply of refined diesel decreased.

Monthly average Gasoil 10 ppm and Mogas 95 prices in nominal terms: April 2021 to March 2023 – cpl

Source: ACCC calculations based on data from Argus Media and the Reserve Bank of Australia.

Notes:

- The shaded area in the chart represents the March quarter 2023.

- The green dotted line indicates when the Russian invasion of Ukraine began (20 February 2022).

- Gasoil 10 ppm is the international diesel benchmark and Mogas 95 is the international petrol benchmark.

Increased Chinese diesel exports, a rise in United States’ diesel inventories and reduced European demand due to a warmer than usual winter helped drive the reduction in Gasoil 10 ppm prices in the March quarter.

“We are pleased that developments in international diesel markets have led to a decrease in the retail price of diesel, a crucial input to many parts of the economy,” ACCC Commissioner Anna Brakey said.

Retail petrol prices were less volatile

“Retail petrol prices in the five largest cities were less volatile in the March quarter, following significant volatility in 2022 due to fluctuating international crude oil and refined petrol prices, and the temporary cut, and subsequent restoration, in fuel excise”, Ms Brakey said.

While quarterly average retail petrol prices across the five largest cities fell slightly, by 0.5 cpl, to 182.2 cpl, they fell by 3.2 cpl in Perth (to 176.6 cpl) and 0.9 cpl in Melbourne (to 184.3 cpl) and rose by 1.5 cpl in Brisbane (to 186.4 cpl). Prices in Sydney rose slightly (up 0.5 cpl) while Adelaide prices recorded a slight drop (down by 0.3 cpl) in the quarter.

The following chart shows movements in seven-day rolling average retail petrol prices in the five largest cities from 1 April 2021 to 31 March 2023. The chart also indicates when fuel excise was cut from 30 March 2022, and when it was restored from 29 September 2022.

Seven-day rolling average retail petrol prices in the five largest cities in nominal terms: 1 April 2021 to 31 March 2023 – cpl

Source: ACCC calculations based on data from FUELtrac.

Notes:

- The shaded area in the chart represents the March quarter 2023.

- The 2 dotted lines indicate the cut in fuel excise from 30 March 2022 and the restoration of full excise from 29 September 2022.

- A 7-day rolling average price is the average of the current day’s price and prices on the 6 previous days.

Retail petrol prices also decreased in the smaller capital cities. On average, petrol prices in Hobart were 4.2 cpl cheaper than in the December quarter, while Darwin prices dropped by 3.2 cpl and Canberra prices were down by 2.0 cpl.

Retail petrol prices in over 190 regional locations in the March quarter averaged 183.1 cpl. The gap between average prices in regional locations and the average of the five largest cities narrowed by 3.4 cpl to only 0.9 cpl. In regional areas in New South Wales, Victoria and Queensland, average petrol prices were below prices in the respective capitals.

Gross indicative retail differences in the five largest cities declined by 0.5 cpl to 11.4 cpl in the quarter, and were 12.2 cpl, below pre-pandemic levels over the year to March 2023. Gross indicative retail differences are the difference between average retail petrol prices and average wholesale prices, and broadly indicate gross retail margins. They do not account for retail operating costs, and should not be interpreted as actual retail profits. In real (inflation adjusted) terms, 12-month average gross indicative retail differences from March 2017 to December 2019 were between 13.6 cpl and 14.6 cpl.

“Less volatile petrol prices in the five largest cities, and declines in prices in most regional locations have been good news for many motorists in the March quarter,” Ms Brakey said.

Note to editors

‘Petrol’ means regular unleaded petrol. The five largest cities are Sydney, Melbourne, Brisbane, Adelaide and Perth.

Singapore Mogas 95 Unleaded (Mogas 95) is the relevant international benchmark for the wholesale price of petrol in Australia. Singapore gasoil with 10 parts per million sulphur content (Gasoil 10 ppm) is the international benchmark for the wholesale price of diesel.

The ACCC uses a seven-day rolling average basis to analyse movements in daily retail petrol prices. A seven-day rolling average price is the average of the current day’s price and prices on the six previous days.

Background

The ACCC has been monitoring retail prices in all capital cities and over 190 regional locations across Australia since 2007.

On 14 December 2022, the Treasurer issued a new direction to the ACCC to monitor the prices, costs and profits relating to the supply of petroleum products in the petroleum industry in Australia and produce a report every quarter for a further three years.