The ACCC continues to support reforms to protect consumers and businesses following a new report into social media services.

The report, released today, has highlighted a range of harms to consumers and small businesses occurring across social media services, including excessive data collection practices, lack of effective dispute resolution options, prevalence of scams, lack of transparency for advertisers and inadequate disclosure of sponsored content by influencers and brands.

The report, which is the ACCC’s sixth in its Digital Platform Services Inquiry, examined competition between social media services in Australia and how consumers and businesses interact with social media services.

“Social media services are an essential part of our daily lives and have provided many benefits to society. But we are concerned about the level of influence social media platforms hold over users and their position as critical intermediaries for businesses to reach customers. Limited competition in these services can lead to poorer outcomes for consumers and small businesses,” ACCC Chair Gina Cass-Gottlieb said.

“This report reinforces the need for reform, including specific mandatory processes for consumers and businesses to report and social media platforms to remove scams, harmful apps and fake reviews, and establishing an external Digital Ombuds Scheme.”

Scams, advertising and influencers

In 2022, Australians reported losses of over $80 million to scams initiated on social media alone. This is up from reported losses of $56 million in 2021 and $27 million in 2020.

“It is clear that social media companies are not doing enough to stop their own users from falling victim to scammers on their platforms, especially as we understand only a fraction of people scammed ever report it,” Ms Cass-Gottlieb said.

Australian businesses rely on social media platforms to advertise their products and engage with consumers. Small and medium businesses are increasingly reliant on platforms like Facebook and Instagram for targeted, easy to use and cost-effective advertising solutions.

“Advertisers have raised concerns about being unable to choose the best services to suit their needs because of the lack of transparency and accuracy of advertising performance data provided to them by social media platforms,” Ms Cass-Gottlieb said.

The report also highlights the growth of the influencer marketing industry and raises concerns about inadequate disclosure of sponsored posts by influencers and brands.

“Consumers are unable to make informed choices about purchases when endorsements and sponsored posts are not clearly disclosed,” Ms Cass-Gottlieb said.

The ACCC launched a sweep earlier this year to identify misleading testimonials and endorsements by social media influencers. The ACCC examined content from more than 100 influencers after receiving over 150 tip-offs from consumers about potentially misleading posts.

“These harms to consumers and small businesses are exacerbated when coupled with what many users consider a lack of effective dispute resolution mechanisms with social media platforms,” Ms Cass-Gottlieb said.

Meta’s significant market power

The ACCC’s report also highlights the significant market power of Meta in social media services, despite the entry of TikTok and smaller platforms such as BeReal.

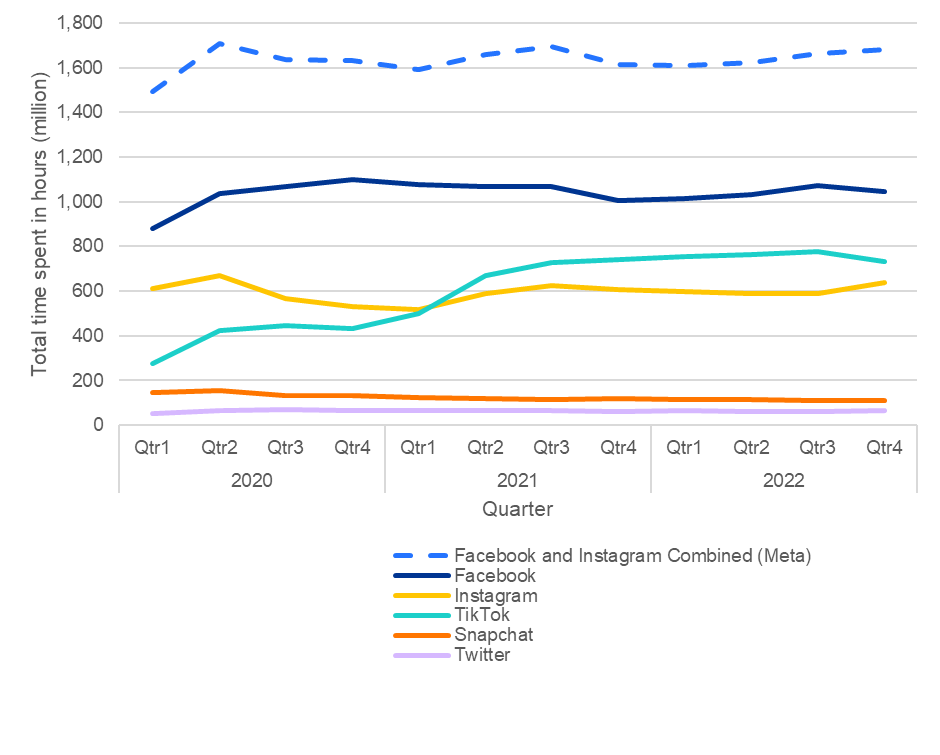

Australians continue to spend more time on Facebook and Instagram combined than any other social media platform, and Meta’s services have the most Australian users and advertisers.

The ACCC considers that Meta’s competitors are not a significant competitive constraint as they are differentiated in their features, how they are used, and in their size and demographics of their user base.

Barriers to entry also remain high, and Meta’s users can face high switching costs as Meta’s platforms (particularly Facebook) have attracted and retained many users for a significant period of time who have invested in uploading material and building a large network of social contacts.

While younger Australians are more likely to use multiple social media services, including new platforms like TikTok and BeReal, older Australians use fewer platforms and still rely heavily on Facebook and Instagram.

Limited competition in social media

The ACCC considers that limited competition among social media platforms means users are more likely to accept conditions they otherwise would reject if there was greater choice.

“Where there are few comparable alternatives available, consumers feel compelled to use a service because their social, family or work networks are on them,” Ms Cass-Gottlieb said.

“This creates a ‘take-it-or-leave-it' situation which can result in consumers accepting unwanted collection and use of their data. Markets can be less dynamic and the quality of services lower due to market power. Consumers can also “pay more”, where the price they pay is exposure to higher levels of advertising and data collection.”

Recommendations

In its Digital Platforms Regulatory Reform Report (released in November 2022), the ACCC made a range of recommendations to address harms to Australian consumers, small businesses, and competition.

“This report builds on the ACCC’s previous work in relation to digital platforms by identifying competition and consumer harms in relation to social media services,” Ms Cass-Gottlieb said.

“We continue to support reforms to address the harms we’ve observed, including an economy-wide prohibition against unfair trading practices, targeted consumer protections and service specific codes of conduct that would apply to designated digital platforms.”

“Globally, similar reforms continue to be progressed. For example, the European Digital Markets Act obligations due to apply in March 2024, and the UK Digital Markets, Competition and Consumers Bill being recently introduced to parliament.”

Background

The ACCC’s Digital Platforms Branch is conducting a five-year inquiry into markets for the supply of digital platform services in Australia and their impacts on competition and consumers, following a direction from the Treasurer in 2020. The ACCC reports to the Treasurer every six months and examines different types of digital platform services.

The main social media services examined in this report are Facebook and Instagram (owned by Meta), Twitter, Snapchat and TikTok. We have also considered other social media services, including YouTube, Reddit, Pinterest, BeReal and LinkedIn.

Previous reports are published at Digital Platform Services Inquiry 2020-2025.

Figure: Total time spent by Australians on key social media platforms per quarter

Source: Sensor Tower data. This chart shows the total time spent by Australian users on social media platforms since 2020. This is measured in millions of hours across all Australian users in the quarter. The measure of ‘all users’ is based on Sensor Tower’s ‘total time spent’ measure, which is an estimate of time spent for all Australian users based on total session count and session duration metrics based on Sensor Tower’s panel, which is then extrapolated to all Australian users.