The Australian Competition and Consumer Commission’s ninth quarterly report on the Australian petroleum industry has found that the December quarter 2016 had the highest quarterly average price since the June quarter 2015. This coincided with unprecedented growth in popularity of fuel price comparison apps and websites as motorists seek out the cheapest fuel in their area.

Prices in the five largest cities (i.e. Sydney, Melbourne, Brisbane, Adelaide and Perth) increased by 7.8 cents per litre (cpl) to 122.0 cpl. In addition, gross retail margins (i.e. the difference between retail prices and wholesale prices) increased by 0.9 cpl to 11.3 cpl. Average gross retail margins in the five largest cities in the 2016 calendar year were 10.6 cpl, which was marginally higher than in 2015.

“Average retail prices in the December quarter 2016 in the largest cities were the highest since the June quarter 2015, while gross retail margins also increased in the quarter,” ACCC Chairman Rod Sims said.

The increase in retail prices during the quarter was significantly influenced by the Organisation of the Petroleum Exporting Countries (OPEC) announcing in late November an agreement to limit crude oil production. The OPEC cartel announced an additional agreement in December with 11 non-OPEC countries (including Russia) to reduce production further.

“International crude oil and refined petrol prices increased because of the OPEC cartel’s decision to restrict oil supply. Cartel conduct leads to higher prices and economic harm and, in this case, it has meant higher prices at the pump for Australian motorists,” Mr Sims said.

“In this higher price environment it is even more important for motorists to shop around for cheaper petrol prices.”

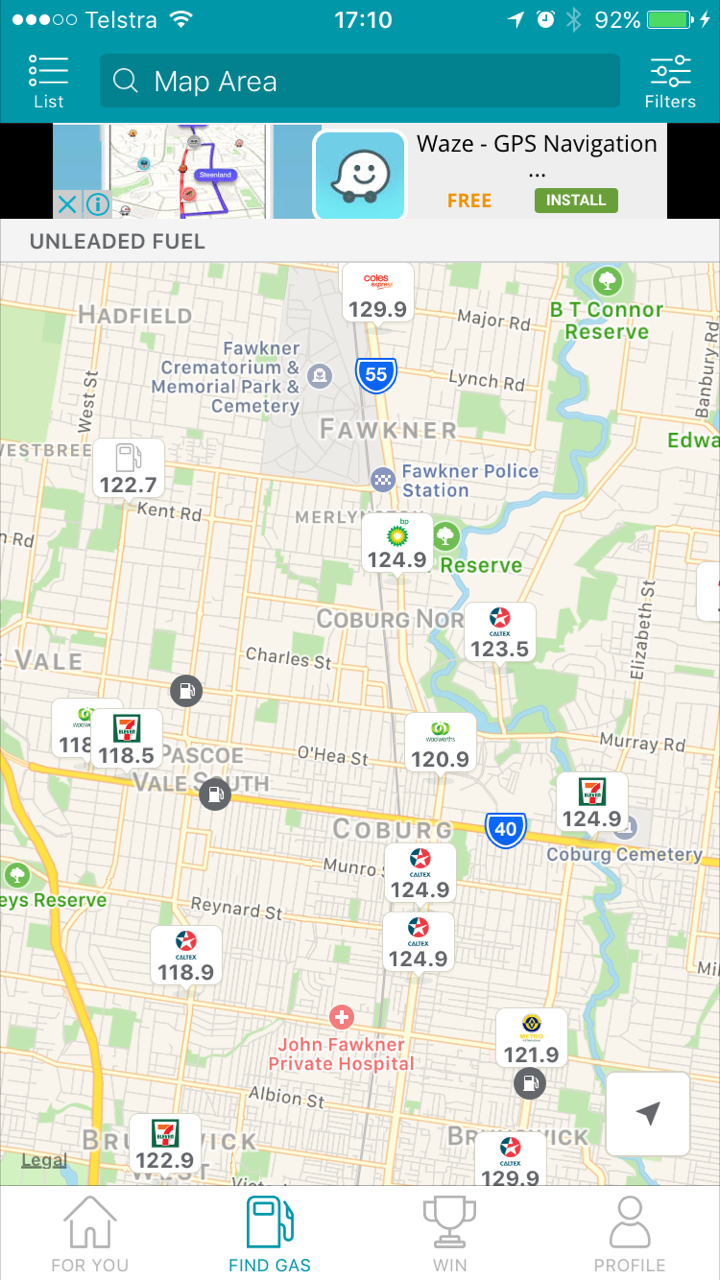

“Fuel price apps and websites are helping motorists to pick the best time and the cheapest location to fill their tanks. The ACCC estimates that by timing their purchases of petrol, and choosing to buy from the lowest priced retailer, motorists filling up a vehicle with a 60 litre tank could save themselves around $10 to $15 per tank of petrol,” Mr Sims said.

The availability and usage of petrol pricing apps and websites increased significantly in 2016. Data collected by the ACCC shows that usage of these websites and apps increased from around 4 million hits in the December quarter 2015 to around 21 million hits in the December quarter 2016.

“The increasing popularity of these websites and apps, and the ability of some to crowd source price data, is helping people play an active role in finding cheaper petrol prices and helping discounting petrol retailers broadcast their lower prices. Petrol websites and apps are beginning to play an important role in providing price transparency and I cannot emphasise enough the importance of price transparency in enabling competition in the retail petrol market,” Mr Sims said.

“The more people that use these websites and apps, the more powerful a role they can play in helping consumers get the lowest prices.”

The number of websites and apps which provide consumers with near real-time retail petrol pricing information increased significantly in 2016. The 7-Eleven, GasBuddy, and NRMA apps, and the NSW FuelCheck website join existing ones, such as the MotorMouth, and Woolworths fuel apps and the MotorMouth and WA FuelWatch websites. Screenshots of the GasBuddy app, and the MotorMouth and FuelCheck websites show the range of prices available to motorists.

Other findings in the report

Price cycles

The ACCC’s report highlighted significant changes that have occurred in the petrol price cycle over the past decade. Price cycles in the four eastern capital cities increased considerably from an average length of 7 or 8 days in 2007 to an average of over 22 days in 2016. Over the same period, the average size of the price cycle increase more than doubled - from an average price jump of around 9 cpl in 2007 to an average of around 20 cpl in 2016.

“Changes in the price cycle have made it harder for consumers to know when the best time to fill up is, and the average price cycle increase is now around 20 cpl. This is another reason for consumers to use petrol apps and websites to find the best time and lowest priced retailer to purchase fuel from,” Mr Sims said.

Retail prices in Brisbane

Retail prices in Brisbane remained the highest of the five largest cities in the December quarter 2016. The average retail petrol price in Brisbane in the December quarter 2016 was 125.1 cpl, which was 3.8 cpl higher than the average across the other four largest cities (an increase of 2.5 cpl from the previous quarter).

As part of the ACCC’s Cairns regional market study, the ACCC is seeking an explanation from the major petrol retailers in Brisbane for the higher prices in Brisbane compared with the four other largest cities. Responses will be included in the Cairns report, expected to be released in the first half of 2017.

Mergers and acquisitions

Two major proposed transactions in the retail fuel industry were announced in the December quarter 2016. These are BP Australia’s proposed acquisition of Woolworths’ fuel sites and Caltex’s proposed acquisition of Milemaker Petroleum’s retail fuel business assets in Victoria.

“These transactions will be closely analysed and assessed by the ACCC as they have the potential to significantly influence the structure and competitive dynamic of the retail petrol sector,” Mr Sims said.

See Report on the Australian petroleum industry—December quarter 2016.

Background

In December 2014, the Australian Government directed the ACCC to monitor the prices, costs, and profits of unleaded petroleum products in Australia for a period of three years.

The ACCC collects retail petrol prices for all capital cities and over 190 regional locations across Australia.